For small businesses, accepting credit card payments is essential — but it comes at a cost. Behind every transaction lies a concealed web of fees charged by banks, card networks, and payment processors. And while recent policy changes in Canada aimed to reduce these costs, many small business owners aren’t seeing the benefits.

In fact, many are paying more than ever — and the reason comes down to pricing models.

Understanding Payment Processing Fees

Every credit card transaction includes several types of fees:

- Interchange fees – Paid to the cardholder’s bank

- Assessment fees – Paid to the card networks (Visa, Mastercard)

- Processor markups – Charged by payment providers

These fees are unavoidable — but how they’re packaged and passed on to your business is what you should pay attention to.

The Government’s Move to Help Small Businesses

In May 2023, the Government of Canada reached an agreement with Visa and Mastercard to reduce interchange fees for small businesses. These changes took effect on October 19, 2024.

Merchants with:

- Under $300,000 in annual Visa sales

- Under $175,000 in Mastercard sales

now qualify for average savings of up to 27% on interchange fees.

The revised Code of Conduct for the Credit and Debit Card Industry also aimed to improve pricing transparency and strengthen merchant protections.

Why Many Merchants Haven’t Seen Savings

Despite these positive developments, many eligible businesses haven’t seen a drop in their processing costs. Why?

Because payment processors ultimately control how fees are applied — and not all have passed the savings along.

At Cartis Payments, we automatically updated our pricing to reflect the new, lower interchange rates. Even merchants not on a pass-through model saw modest reductions.

Unfortunately, some large processors are taking a different approach.

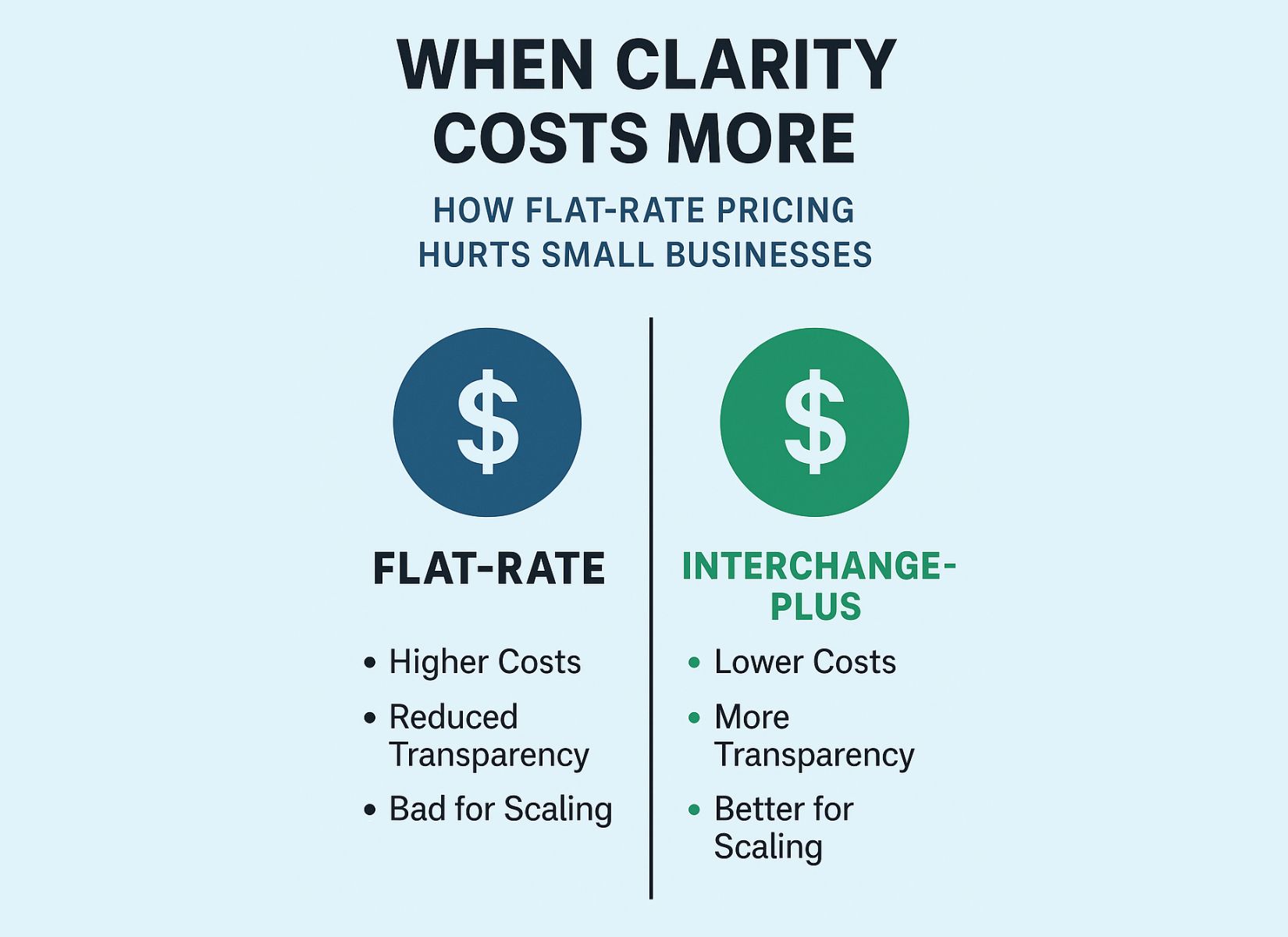

The Rise of Flat-Rate Pricing: A Step Backward

In response to interchange reductions, many large processors are migrating small and mid-sized merchants to flat-rate pricing. This pricing model, popularized by companies like Square, Stripe, and PayPal, offers a single blended rate for all transactions.

It’s marketed as being “simple” or “transparent,” but for most small businesses, it results in higher costs and less visibility.

| Feature | Flat-Rate Pricing | Interchange‑Plus Pricing |

|---|---|---|

| Fee Structure | Fixed rate regardless of card type | Variable rate based on actual card cost |

| Cost Efficiency | Typically higher | Lower, especially for basic cards |

| Transparency | Minimal fee breakdown | Full visibility into each fee |

| Scalability | Penalizes growth | Rewards volume with better rates |

Flat-rate pricing averages the cost across all transactions — meaning merchants pay the same high rate whether a customer uses a premium rewards card or a basic debit card. In contrast, interchange‑plus pricing allows merchants to benefit from lower‑cost cards and provides a detailed breakdown of every charge.

Small Businesses Deserve Better

Ironically, the very businesses meant to benefit from the government’s fee reduction are now being shifted to pricing models that obscure costs and eliminate savings.

While interchange‑plus pricing is still available, it’s increasingly being offered only to larger merchants. Small businesses are left with flat‑rate plans that trade real savings for perceived simplicity.

The Cartis Payments Difference

At Cartis, we believe all businesses — no matter their size — deserve access to fair, transparent, and scalable pricing.

Here’s how we support our merchants:

- Transparent pricing models: We offer interchange‑plus or simplified cost‑based pricing to all eligible merchants.

- Automatic savings: We pass on interchange reductions as soon as they become available.

- Merchant education: We help business owners understand their statements so they know exactly what they’re paying — and why.

Simple Isn’t Always Better

Flat‑rate pricing often hides rising costs behind a single number. True transparency means knowing where every dollar goes — and having the power to optimize your costs.

If your credit card processing rates haven’t gone down — or worse, have gone up — it’s time to ask questions and make changes.

At Cartis Payments, we’re here to help you find the answers — and the savings.

Ready to Take Back Control of Your Processing Costs?

Contact us today to get a free review of your merchant statement — and see how much you could be saving with transparent, scalable pricing.